Privacy: Bartering Data for Services

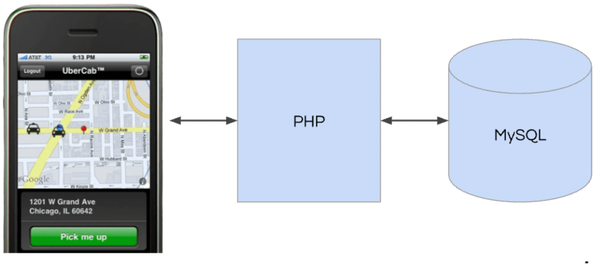

Data is the new currency. A phrase we’ve heard frequently in the wake of the story of Unroll.me selling user data to Uber.

Two keys to that story:

- Users didn’t realize their data was being sold.

- Free services can be considered a sophisticated form of phishing attack.

In both cases prevention requires user awareness. How do we get user awareness? Force meaningful disclosure. How do we force meaningful disclosure? Here’s an odd thought: use the tax system.

If data is the new currency then why isn’t exchanging data for use of a service a barter transaction? If a doctor exchanges medical services for chickens, for example, that is a taxable event at fair market value. It's a barter arrangement. A free service that sells user data is similarly bartering the service for data, otherwise said service would not be offered.

How would it work?

Service providers send out 1099-Bs to users for the fair market value of the service. Fair market value could be determined using a similar for pay service or as a percentage of the income generated from the data being sold.

The IRS treats barter transactions as income received. Users would need to pay income tax for the “free” services they use that sell their data.

What would it accomplish?

Force disclosure by services. Businesses making money selling data would be forced to inform their users that they are doing so because it’s required for tax accounting.

Eyes Wide Open. Users would know for certain that the services they are using are selling their data. They could then determine if the relationship is worth the cost.

This would not prevent free service for data arrangements. There’s nothing wrong with exchanging data for a service, but everyone should enter such a transaction knowingly.